Aid Rates in Development Law 4887/2022

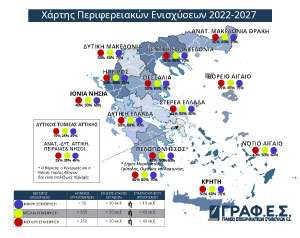

Greece's Regional Aid Map 2022-2027 defines the Greek regions eligible for regional investment aid for the new Development Law 4887/2022. The map establishes the maximum aid intensities in the eligible regions.

The aid intensity is the maximum amount of State aid that can be granted per beneficiary, expressed as a percentage of eligible investment costs.

According to the Regional Aid Map for the period 2022-2027

Maximum aid rates per region

| REGIONS | LARGE ENTERPRISES | MEDIUM-SIZED ENTERPRISES | SMALL ENTERPRISES |

|---|---|---|---|

| Central Macedonia | 50% | 60% | 70% |

| Western Macedonia | 50% | 60% | 70% |

| Eastern Macedonia - Thrace | 50% | 60%(1) | 70% |

| Epirus | 50% | 60% | 70% |

| Thessaly | 50% | 60% | 70% |

| Crete | 50% | 60% | 70% |

| North Aegean | 55% | 65% | 75% |

| South Aegean | 40% | 50% | 60% |

| Ionian Islands | 40% | 50% | 60% |

| Western Greece | 50% | 60% | 70% |

| Central Greece | 40% | 50% | 60% |

| Peloponnese (except the Municipalities of Megalopolis, Tripoli, Oichalia and Gortynia)(2) | 40% | 50% | 60% |

| Western Athens | 15% | 25% | 35% |

| East Attica, West Attica, Piraeus/ Islands of Attica | 25% | 35% | 45% |

The North, Central and South Sectors of Athens are not eligible areas in the New Development Law 4887/2022

(1) In the regional units of Rhodope, Evros, and Xanthi, medium-sized enterprises are eligible for cash grants in the New Development Law 4887/2022. The rate of these cash grants is set at sixty percent (60%) for the regional unit of Evros and thirty percent (30%) for the regions of Rhodope and Xanthi. Furthermore, the remaining rates of tax exemption are set at forty percent (40%) and seventy percent (70%) respectively, in accordance with the provisions of this regulation. In addition to the cash grants and tax exemptions, there is an additional bonus applicable to the above-mentioned regions, regardless of the size of the enterprise. This bonus amounts to ten percent (10%) for the Regional Unit of Evros and five percent (5%) for the regions of Rhodope and Xanthi.

(2) For investment projects implemented in the Municipalities of Megalopolis, Tripoli, Oichalia and Gortynia, the aid rate for small and micro enterprises is set at 70%, for medium-sized enterprises at 60% and for large enterprises at 50%.

Aid intensity

The percentages of aid per type of aid for the eligible expenses are granted based on the maximum intensity limits of the Regional Aid Chart as follows:

| SIZE | Tax exemptions | Cash Grants | Leasing subsidies | Employment subsidy |

|---|---|---|---|---|

| Small businesses | 100% (max.% of the Regional Aid Map) |

80% (max.% of the Regional Aid Map) |

100% (max.% of the Regional Aid Map) |

100% (max.% of the Regional Aid Map) |

| 90% or 100% of the Regional Aid Map in the special categories* | ||||

| Medium-sized enterprises | 80% (max.% of the Regional Aid Map) |

- | 80% (max.% of the Regional Aid Map) |

80% (max.% of the Regional Aid Map) |

| 90% or 100% of the Regional Aid Map in the special categories* | - | 90% or 100% of the Regional Aid Map in the special categories* | 90% or 100% of the Regional Aid Map in the special categories* | |

| Large enterprises | 80% (max.% of the Regional Aid Map) |

- | 80% (max.% of the Regional Aid Map) |

80% (max.% of the Regional Aid Map) |

| 90% or 100% of the Regional Aid Map in the special categories* | - | 90% or 100% of the Regional Aid Map in the special categories* | 90% ή 100% of the Regional Aid Map in the special categories* |

*Special categories. Increased aid rates are granted for investment projects that:

- Mountainous areas, according to the classification of the Hellenic Statistical Authority (EL.STAT.), outside the municipalities that form part of the urban complex of Athens. Islands with a population of less than three thousand one hundred (3,100) inhabitants, and which have been affected by natural disasters.

- Industrial and Business Areas (Β.Ε.ΠΕ.), Business Parks (Ε.Π.), excluding Intermediate Enterprise Parks (Ε.Π.Ε.Β.Ο.), Technology Parks and Innovative Activity Hosts (Θ.Υ.Κ.Τ.). and Organised Hosts of Manufacturing and Business Activities (Ο.Υ.Μ.Ε.Δ.), provided that they do not concern the modernisation or extension of existing structures of the assisted firm,

- They are implemented in buildings classified as preserved (90% of the Regional Support Map)

- Reopening of industrial units which have ceased to operate at least two years before the application for aid is submitted.